Banks face digital skills gap; urgent need for workforce transformation

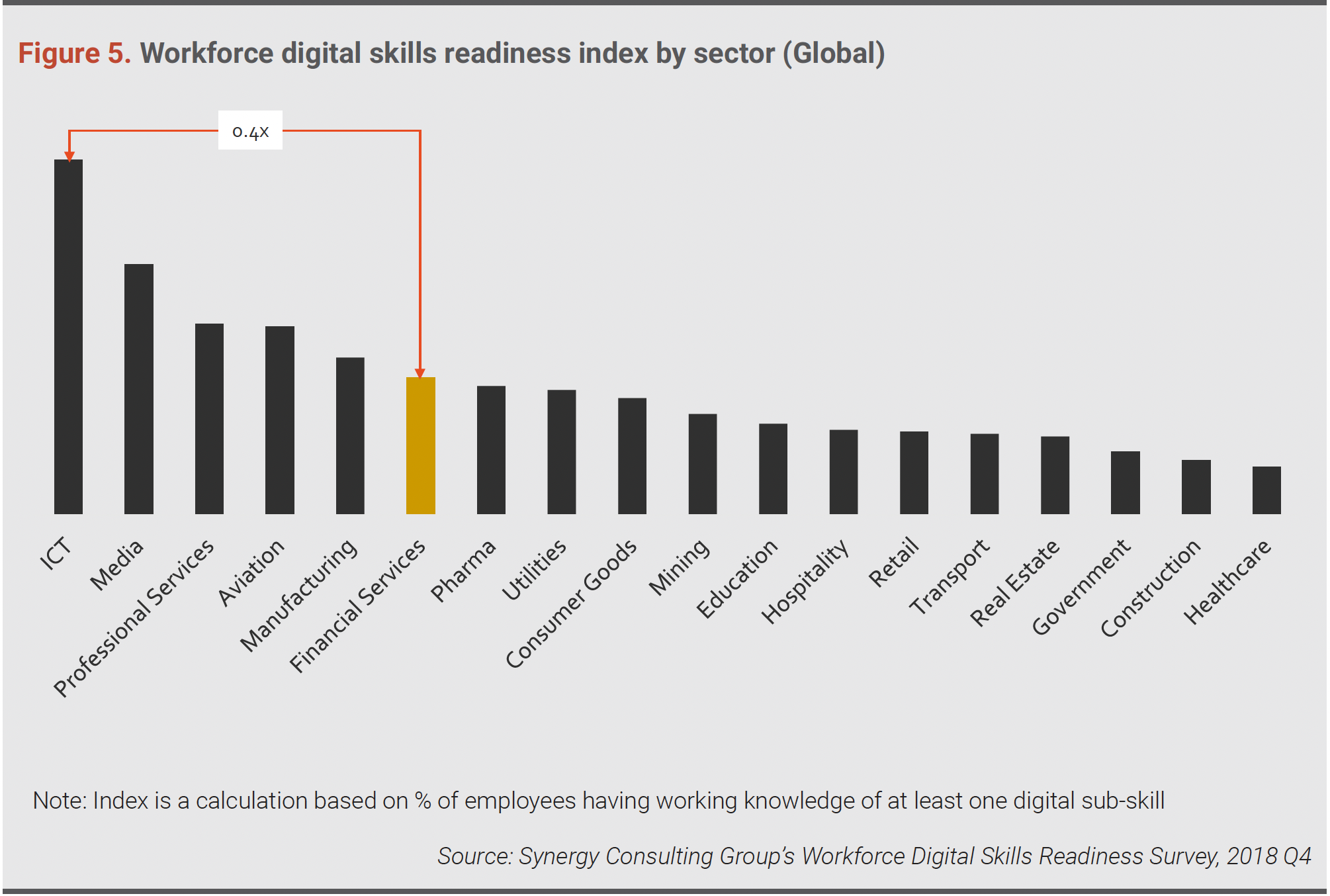

DIGITAL TRANSFORMATION IN BANKING is no longer optional; it is the price of staying relevant. Yet, compared with ICT, media, or aviation, most banks remain under-skilled—and every quarter of delay widens the gap.

To learn more about bridging the digital skills gap in banking and unlocking the full potential of your organization, access our white paper: Closing the Digital Skills Gap in the Middle East Banking Industry

Exhibit 1: Workforce digital-skills readiness index by sector (Global)

Because financial-services talent trails other industries, competitive gaps widen quickly. Consequently, every month of inaction erodes market share.

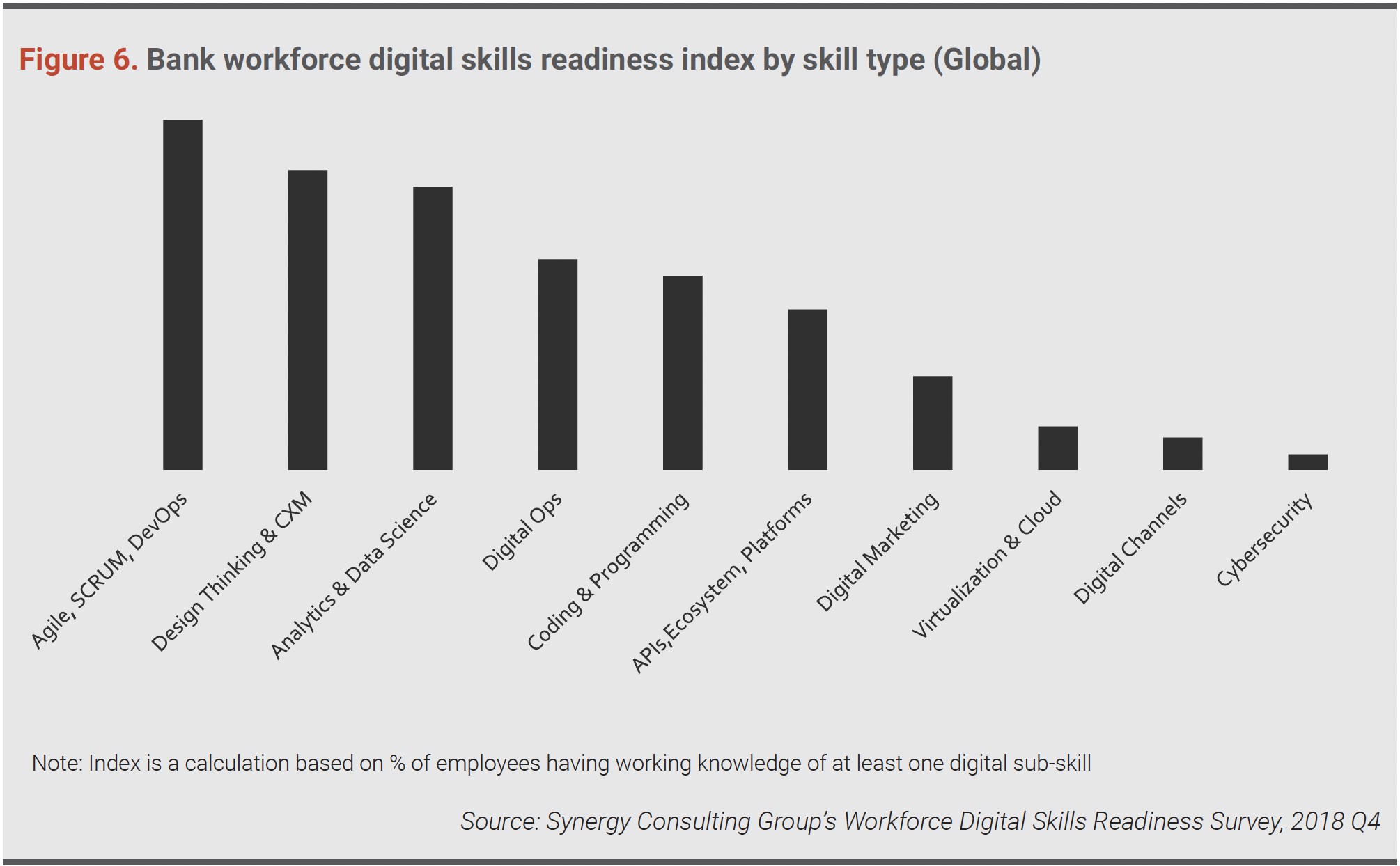

Across 200 surveyed banks, skill adoption is uneven:

Exhibit 2: Bank workforce digital-skills readiness index by skill type (Global)

Although some progress exists, banks remain on the cusp of disruption. Moreover, every day the sector delays wide-scale up-skilling, competitors surge ahead.

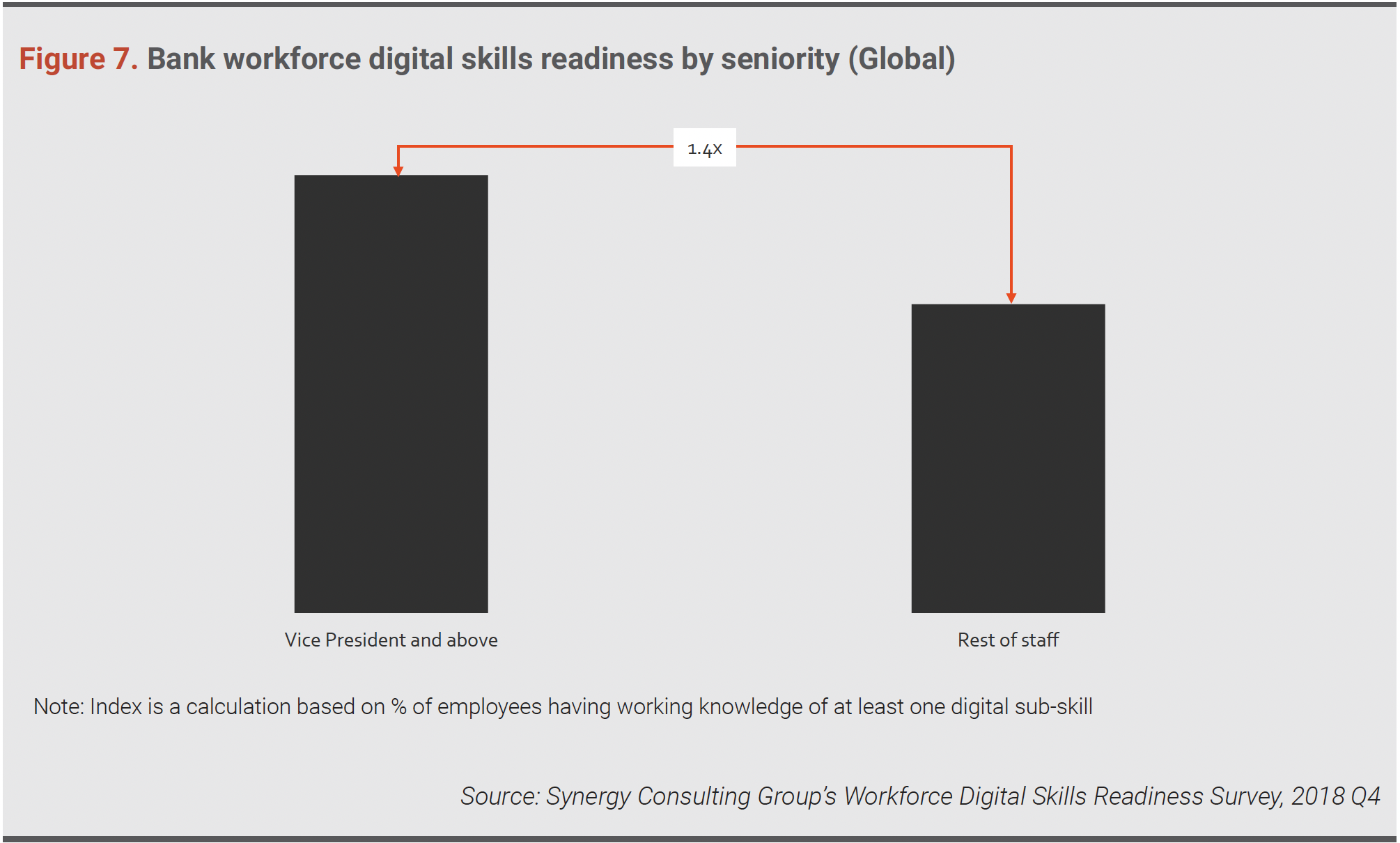

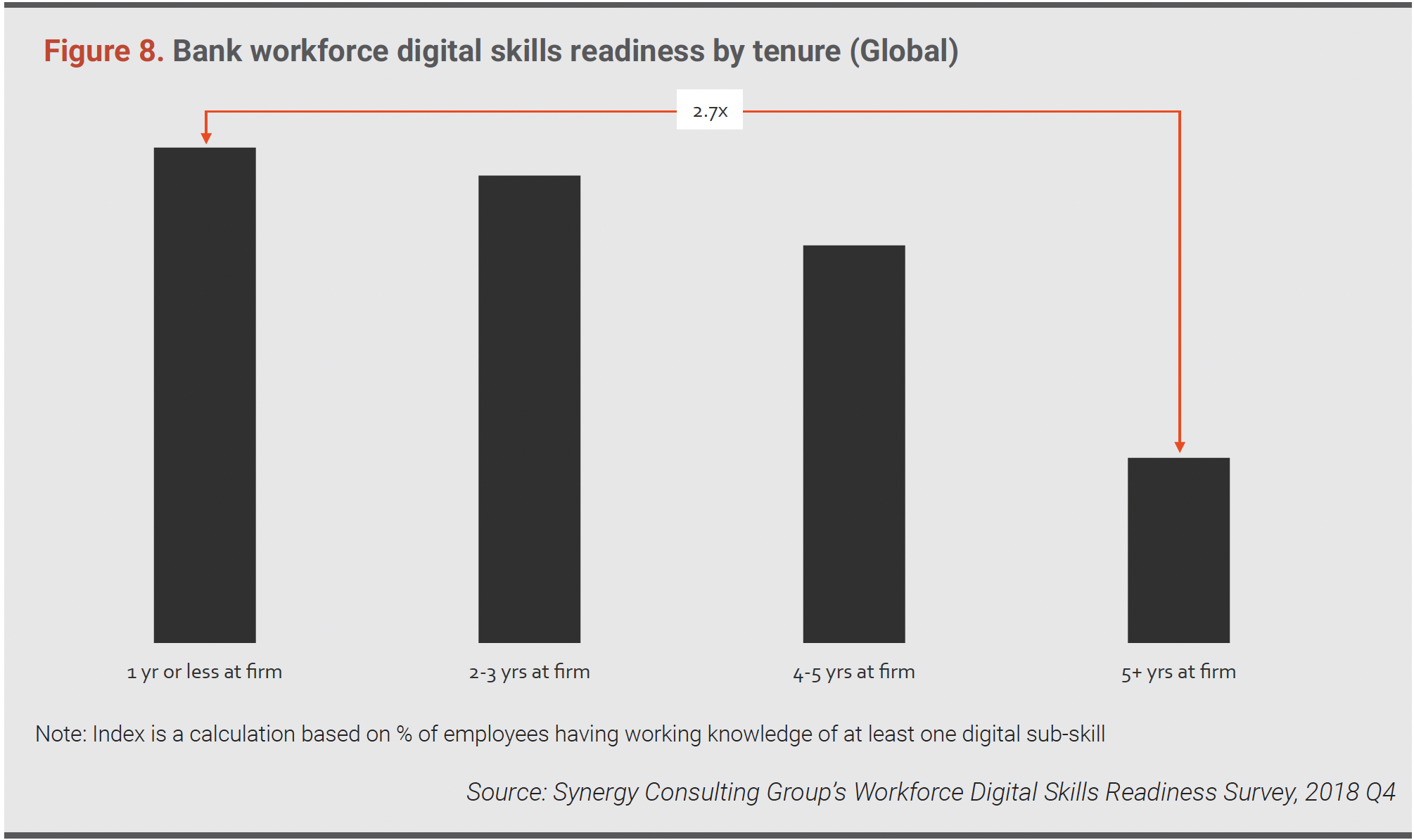

Our data reveals a striking pattern: senior executives often score higher on digital skills than frontline staff. Meanwhile, new hires outshine long-tenured colleagues.

Exhibit 3: Bank workforce digital-skills readiness by seniority (Global)

Exhibit 4 – Bank workforce digital-skills readiness by tenure (Global)

Because knowledge decays quickly, long-serving employees require re-skilling. Otherwise, transformation stalls.

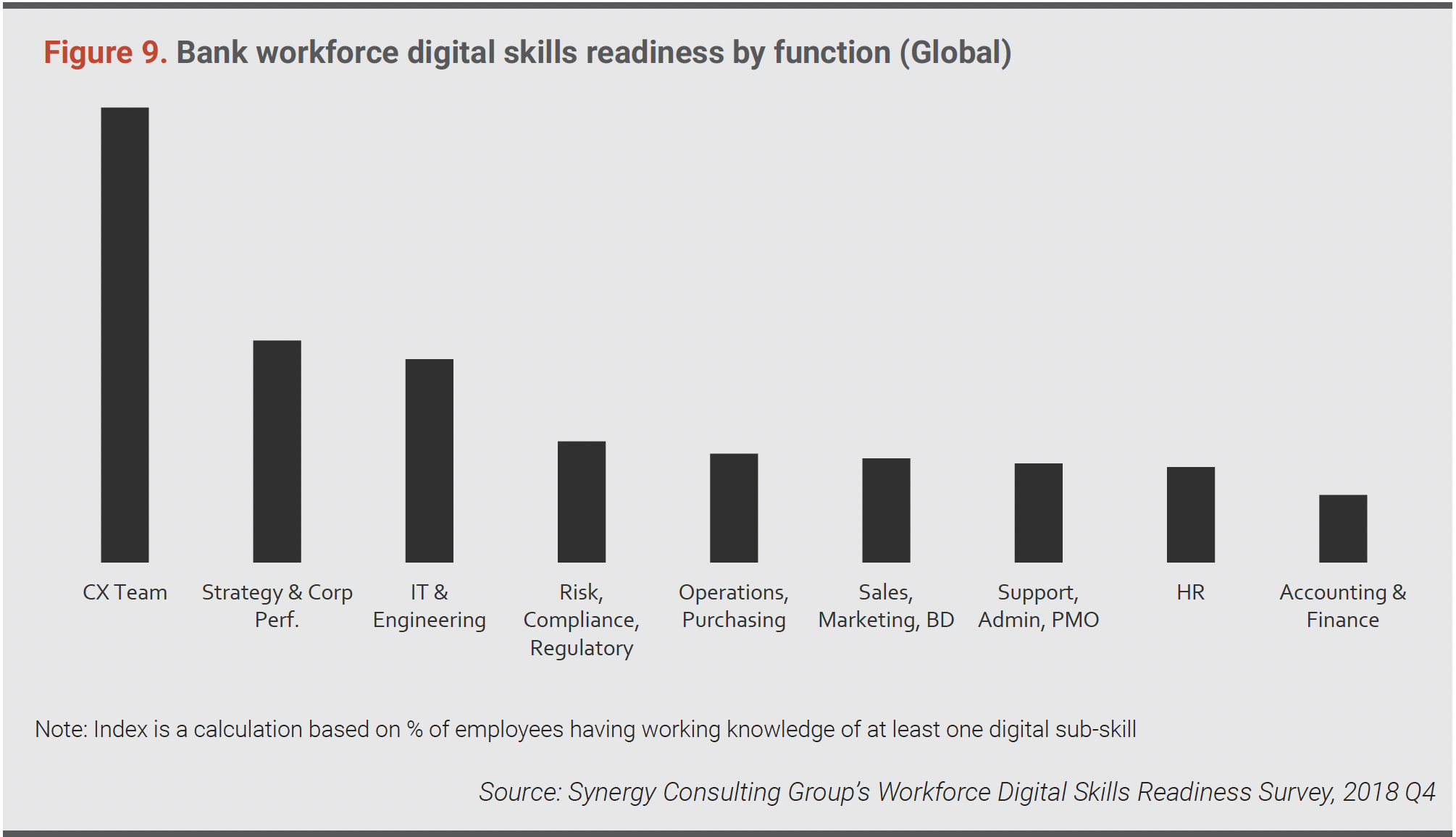

Digital leaders concentrate skills in three areas—IT, strategic planning and customer experience. Conversely, core operations, procurement, finance and accounting trail badly.

Exhibit 5: Bank workforce digital-skills readiness by function (Global)

Since back-office functions underpin customer journeys, gaps here ripple across the enterprise. Thus, a holistic approach is essential.

Because each step reinforces the next, momentum builds quickly. Consequently, competitive gaps narrow.

Digital transformation in banking demands a workforce ready for cloud, data and design. Therefore, banks must invest in continuous learning today. In addition, they should foster a culture that celebrates experimentation.

Further Reading:

To learn more about bridging the digital skills gap in banking and unlocking the full potential of your organization, access our white paper: Closing the Digital Skills Gap in the Middle East Banking Industry

If you have questions about how Synergy Consulting Group can help you develop strategy – please